In today's global economy, navigating tax regulations across jurisdictions is complex. Tax Documents UK translation services provide crucial expertise, ensuring compliance and avoiding legal issues through accurate financial statement, tax form, and contract translations. These specialized services employ qualified linguists with tax knowledge to handle international transactions, preserving document validity and minimizing errors that could lead to costly penalties. Choosing a reputable service with advanced tools and rigorous quality assurance is essential for businesses and individuals seeking seamless tax management in the UK market. Automation and AI technologies are driving future advancements, aiming to streamline processes and enhance accuracy in handling intricate tax forms globally.

In today’s globalised economy, accurate tax document translation services are essential for individuals and businesses operating across borders. This article delves into the critical importance of precise tax translations in the UK, exploring the challenges of multilingual tax documentation and providing insights on choosing the right service. We’ll also discuss advanced techniques, successful case studies, and future trends shaping this vital industry.

- Understanding the Importance of Accurate Tax Document Translations

- The Challenges of Tax Documentation in a Multilingual Environment

- Key Factors to Consider When Choosing a Tax Document Translation Service

- Advanced Techniques and Tools for Ensuring Precision in Tax Translations

- Case Studies: Successful Tax Document Translation Projects

- Future Trends in Tax Document Translation Services

Understanding the Importance of Accurate Tax Document Translations

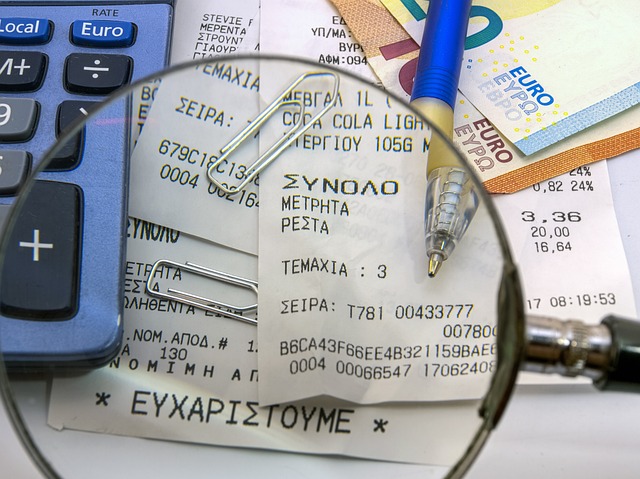

In today’s globalised economic landscape, businesses and individuals often find themselves navigating complex tax regulations in multiple jurisdictions. Accurate tax document translations play a pivotal role in ensuring compliance and minimising potential legal pitfalls. When it comes to tax affairs, precision is paramount; a simple translation error can lead to significant consequences, including fines or even legal disputes.

Tax documents UK translation services that are specialised and reliable are therefore indispensable. These services employ qualified linguists with expertise in taxation who understand the nuances of both the source and target languages. They meticulously translate financial statements, tax forms, and contracts, preserving accuracy and ensuring that the translated documents remain legally binding. This is especially crucial when dealing with international transactions or cross-border partnerships.

The Challenges of Tax Documentation in a Multilingual Environment

In today’s globalised economy, businesses and individuals often find themselves operating across borders, leading to a complex web of tax obligations. This presents a significant challenge when it comes to tax documentation, as the process requires precise translation services to ensure compliance with local regulations. Tax documents, by their very nature, are detailed and technical, making accurate translations essential. The slightest error can result in costly consequences, including penalties and delays.

The multilingual nature of international business means that tax authorities worldwide receive documents in various languages. This presents a unique set of difficulties for translators, who must not only master the language but also understand the nuances and specific terminology used in tax documentation. Tax Documents UK translation services play a vital role here, ensuring that clients’ tax affairs are managed efficiently and correctly, regardless of the language barrier.

Key Factors to Consider When Choosing a Tax Document Translation Service

When selecting a tax document translation service, particularly for documents in the UK, several critical factors come into play to ensure accuracy and compliance. First and foremost, expertise is paramount. Look for providers with a proven track record and specialist knowledge in financial and legal translations, especially within the tax sector. This ensures that translators are adept at handling complex terminology and concepts accurately.

Reputation and quality assurance are also essential considerations. Check for reviews and testimonials from previous clients to gauge the service’s reliability. Reputable translation companies often employ rigorous quality control measures, including proofreading and editing processes, to guarantee error-free translations. These steps are vital when dealing with tax documents, where even minor inaccuracies can have significant consequences.

Advanced Techniques and Tools for Ensuring Precision in Tax Translations

In the realm of tax document translation services, ensuring precision is paramount to avoid legal and financial pitfalls. Advanced techniques and tools play a crucial role in achieving accuracy, especially when navigating complex tax codes and terminologies. Professional translators in the UK employ machine translation (MT) platforms integrated with human expertise for optimal results. These systems leverage vast databases and artificial intelligence to deliver initial translations, which are then meticulously reviewed and edited by certified specialists.

Moreover, contextual analysis tools help translate terms accurately within specific financial frameworks. Advanced software also facilitates consistent terminology management, ensuring the same words and phrases are used across all documents. This reduces ambiguity and enhances comprehension for tax authorities. With these sophisticated methods, UK translation services guarantee that tax documents are not just word-for-word translated but seamlessly adapted to reflect local regulations and practices, thereby streamlining the compliance process for international businesses.

Case Studies: Successful Tax Document Translation Projects

Successful Tax Document Translation Projects

Many businesses and individuals across the UK have benefited from professional tax document translation services, leading to smoother operations and compliance with local regulations. Case studies highlight the impact of accurate translations in various scenarios. For instance, a multinational corporation expanding into the UK market faced the challenge of translating complex tax forms and financial statements for regulatory submission. By engaging specialized translators experienced in tax documentation, they ensured precise translations that met both legal requirements and internal accounting standards.

Another successful project involved an international accountancy firm assisting clients with cross-border transactions. Their translation services team delivered accurate interpretations of tax documents from multiple languages, enabling seamless communication and compliance for their diverse client base. These examples demonstrate the value of professional tax document translation in facilitating international business activities while maintaining the integrity of financial information.

Future Trends in Tax Document Translation Services

As technology continues to evolve, so too does the landscape of tax document translation services in the UK. Future trends indicate a greater emphasis on automation and machine learning, which can significantly speed up translation times while maintaining accuracy. AI-powered tools are already showing promising results in handling complex linguistic nuances, ensuring precise translations for intricate tax forms.

Another emerging trend is the integration of Translation Memory (TM) technology, which stores and reuses previously translated segments, enhancing consistency across multiple documents. This approach not only improves efficiency but also reduces potential errors that might occur during manual translation processes. With the increasing globalisation of businesses and cross-border transactions, these advancements in tax document translation services will undoubtedly play a pivotal role in facilitating smooth and accurate financial reporting worldwide.

When it comes to tax documents, precision is paramount. In a globalised economy, businesses operating across borders rely on accurate translations to navigate complex tax regulations. Choosing the right UK tax document translation service, armed with advanced techniques and tools, can significantly mitigate risks and streamline processes. By understanding the challenges, considering key factors, and learning from successful case studies, organisations can ensure compliance and foster a robust financial strategy in a multilingual environment.