UK-based corporations with international operations or foreign subsidiaries require precise and certified translations of their corporate tax documents for compliance across various jurisdictions. Specialist UK Corporate Tax Documents translation services offer accurate translations into multiple languages, ensuring these financial records meet the legal standards required for international mergers, acquisitions, and cross-border litigation. These translations are legally binding, provided by professional translators endorsed by accreditation bodies like the Institute of Translation and Interpreting (ITI) or the Chartered Institute of Linguists (CIOL). This certification is crucial for establishing the authenticity of financial information within regulatory frameworks. Companies must choose translation services with a deep understanding of both linguistic nuances and the specificities of UK corporate tax law to ensure accurate representation of all numerical data, legal terms, and contextual details in translated documents. These translations facilitate seamless tax compliance and are indispensable for businesses navigating the multicultural and trade-diverse environment of the UK. The use of professional UK Corporate Tax Documents translation services is essential for maintaining transparency and adhering to legal requirements within the international business arena.

navigating the complexities of international business, UK corporations often encounter the necessity for precise and certified translations of their tax documents. This article delves into the critical role of professional translators in converting financial data accurately, ensuring compliance with legal requirements. We explore the nuances between certified and non-certified translations, providing a step-by-step guide to facilitate the process. With a focus on UK Corporate Tax Documents translation services, we present case studies that exemplify successful tax filings enhanced by certified translations. Understanding the intricacies of this process is essential for any business operating across borders, ensuring seamless communication and adherence to legal standards.

- Understanding the Necessity for Certified Translation of UK Corporate Tax Documents

- The Role of Professional Translators in Handling Sensitive Financial Data

- Key Differences Between Certified and Non-Certified Translations

- Step-by-Step Guide to Certified Translation of Corporate Tax Returns

- Legal Requirements for UK Corporate Tax Documents Translation

- Choosing the Right UK Corporate Tax Documents Translation Services

- Case Studies: Successful Tax Filing with Certified Translations in the UK

Understanding the Necessity for Certified Translation of UK Corporate Tax Documents

When UK-based corporations engage in international transactions or have subsidiaries abroad, the necessity for certified translations of their tax documents becomes paramount. The UK Corporate Tax Documents translation services are specialized in converting these vital financial records into languages that are intelligible to foreign regulatory bodies and business partners. This ensures compliance with legal requirements in countries where these documents may be submitted as part of mergers, acquisitions, or cross-border litigation. Certified translations provide a legally binding assurance that the translated content accurately reflects the original text. They come with a statement of accuracy from a professional translator who is accredited by relevant authorities, such as the Institute of Translation and Interpreting (ITI) or the Chartered Institute of Linguists (CIOL) in the UK. This certification is crucial for international entities to trust the authenticity of the financial information presented, thereby facilitating seamless operations across borders. Moreover, these translations are indispensable for multinational corporations to meet the stringent tax compliance standards globally, ensuring that their tax filings are understood and accepted by foreign tax authorities without any ambiguity or misinterpretation. Utilizing UK Corporate Tax Documents translation services is not just a strategic business move but a legal imperative in an increasingly globalized economy.

The Role of Professional Translators in Handling Sensitive Financial Data

When it comes to the intricate process of translating UK Corporate Tax Documents, professional translators play a pivotal role in ensuring accuracy and compliance with legal standards. The translation of financial documents such as tax returns, filings, and audits is not merely a matter of linguistic equivalence but requires a deep understanding of both the source and target languages as well as the financial terminology specific to corporate taxation. Translators specializing in this field undergo rigorous training to handle sensitive financial data with the utmost confidentiality and precision, adhering to stringent industry standards and legal requirements. Their expertise is crucial for multinational corporations operating in diverse linguistic environments, as they must accurately convey complex fiscal information across different languages without altering its meaning or implication.

The UK Corporate Tax Documents translation services provided by these experts are indispensable for companies seeking to expand their operations internationally. These services not only facilitate communication between entities but also ensure that all financial obligations are met in accordance with the laws of each country involved. The translation process is further complicated by the need to maintain consistency across documents, which is essential for audit trails and legal proceedings. Professional translators, therefore, employ advanced tools and technologies to guarantee the integrity of the translated content, thereby enabling companies to navigate international tax regulations with confidence. Their role in this highly specialized field is critical, as it encompasses not only a mastery of languages but also an understanding of the financial and legal contexts that govern corporate tax compliance worldwide.

Key Differences Between Certified and Non-Certified Translations

When companies operating within or expanding into the UK need to present their corporate tax documents in a language other than English, the accuracy and credibility of the translated content are paramount. Certified translations stand apart from non-certified translations in several critical aspects, particularly when it comes to legal and financial documentation such as UK Corporate Tax Documents. A certified translation is performed by a professional translator who has been officially accredited, ensuring that the translated document is a true and exact representation of the original text. This certification often comes with a signed statement from the translator or translation agency, affirming the authenticity of the translation.

In contrast, non-certified translations may be executed by less specialized individuals, potentially leading to discrepancies or misinterpretations that could have serious implications for the company’s compliance with UK tax laws. The key difference lies in the validation of the translated content; certified translations are legally recognized and can be submitted to government bodies, courts, and other official entities. Non-certified translations, while potentially more cost-effective, lack this legal backing and may not be accepted for formal proceedings or processes related to UK Corporate Tax Documents translation services. When accuracy, compliance, and legal recognition are non-negotiable, companies must opt for certified translations to navigate the complexities of tax filings in a multilingual context.

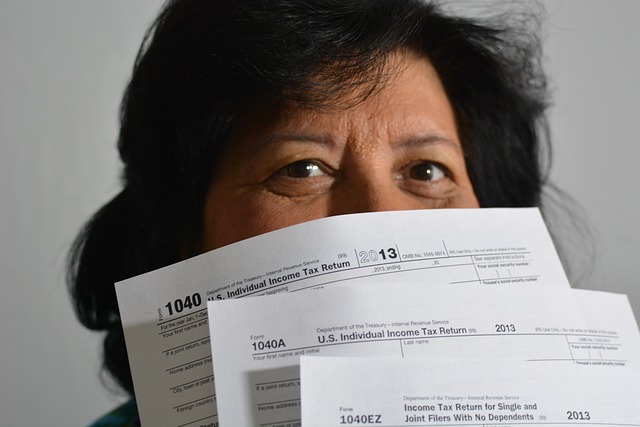

Step-by-Step Guide to Certified Translation of Corporate Tax Returns

When corporate entities operating within the UK need to submit their tax returns, accuracy and compliance with legal requirements are paramount. Should these documents require translation for submission in a different jurisdiction or for official purposes within the UK, certified translations become necessary. A certified translation involves a professional translator providing a literal and precise translation of the original document, accompanied by a statement signed and dated by the translator attesting to the accuracy of their work. This process not only ensures that the translated text reflects the exact contents of the original but also confirms the translator’s proficiency and responsibility towards the legal implications of their translation.

To initiate the certified translation of UK Corporate Tax Documents, businesses should first select a reputable translation service provider that specializes in legal and financial translations. These providers often have native-speaking translators with expertise in corporate tax law and an understanding of the specific terminology used in such documents. The process commences with the client providing the original tax return documents to the chosen translation service. The translator will then translate the document, taking into account all relevant legal terms and financial concepts that must be precise to avoid misinterpretation by authorities or stakeholders. Upon completion, the translated document is reviewed for accuracy and completeness. Once verified, the translator affixes a certificate of translation, known as an attestation clause, which confirms that the translation is complete and accurate to the best of their knowledge and ability. This certified translation can then be submitted alongside the original documents, ensuring compliance with legal standards and facilitating international communication or regulatory obligations. Utilizing UK Corporate Tax Documents translation services that adhere to these meticulous steps ensures that your corporate tax returns are handled professionally and in accordance with legal requirements.

Legal Requirements for UK Corporate Tax Documents Translation

When UK-based companies operate internationally or engage with foreign entities, the need for accurate and compliant translation of corporate tax documents arises. The legal requirements for UK corporate tax documents translation are stringent due to the sensitive nature of financial information. Translation services specializing in UK corporate tax documents must adhere to the high standards set by the UK’s Office for Students (OfS) and other regulatory bodies that govern financial records. These translations must be precise, reflecting the exact content of the original documents, and carry the same legal weight as the originals. Professional UK corporate tax documents translation services ensure that all nuances of the tax laws and accounting principles are accurately conveyed in the target language. This is crucial for multinational corporations to comply with international tax regulations and avoid legal pitfalls. The translators must be well-versed not only in linguistic accuracy but also in the technical aspects of corporate taxation, ensuring that the translated documents align with the legal and fiscal expectations across different jurisdictions. Additionally, these translation services often provide certified translations, which come with a signed statement of accuracy and are legally recognized by both UK and foreign authorities. This certification process further underscores the reliability and authenticity of the translations, making them indispensable for companies navigating the complexities of cross-border tax compliance.

Choosing the Right UK Corporate Tax Documents Translation Services

When engaging with the complexities of international business, the accuracy and professionalism of UK Corporate Tax Documents translation services become paramount. Companies dealing with cross-border transactions must ensure that their tax returns and filings are accurately translated to facilitate compliance with foreign jurisdictions’ legal requirements. The right translation service in the UK will offer not only linguistic expertise but also a deep understanding of corporate tax legislation, ensuring that all numerical data, legal terminologies, and financial nuances are conveyed precisely. These services are typically staffed by certified translators who specialise in accounting and finance, providing assurance that the translated documents reflect the original content’s intent and precision. In addition to linguistic proficiency, these service providers often offer additional support, such as navigating different tax regimes and liaising with regulatory bodies, which can be instrumental in mitigating the risks associated with non-compliance or misrepresentation due to language barriers. Thus, choosing a reliable UK Corporate Tax Documents translation services is a strategic decision that can significantly influence the success of your company’s international operations.

Case Studies: Successful Tax Filing with Certified Translations in the UK

Companies operating in the UK’s diverse business landscape often encounter the necessity to submit corporate tax documents in both English and other languages, given the country’s multicultural composition and international trade relationships. A prime example of this is a multinational corporation with subsidiaries across Europe. To ensure compliance with UK tax regulations, they required annual tax returns and financial statements to be translated accurately from various languages into English. The challenge was not just linguistic but also technical, as the translations had to maintain the original document’s meaning, format, and integrity. By engaging with professional UK Corporate Tax Documents translation services, the company successfully navigated this complexity. The translated documents were accepted by the UK tax authorities without issue, enabling timely and accurate tax filings. This case study underscores the importance of precise and certified translations when dealing with international corporate tax obligations in the UK. Similarly, a UK-based subsidiary of an overseas parent company faced difficulties due to tax returns originally prepared in a non-English language. The certified translation service provided by a reputable agency not only facilitated a seamless filing process but also demonstrated adherence to legal requirements set forth by HM Revenue & Customs (HMRC). This instance highlights the critical role of professional translators who are adept at not only understanding linguistic nuances but also the specific terminology within corporate tax contexts, ensuring that all disclosures and calculations are accurately conveyed. These examples serve as testaments to the indispensable nature of UK Corporate Tax Documents translation services in achieving compliance and transparency for businesses in an international marketplace.

When navigating the complexities of international tax compliance, the importance of accurate and certified translations of UK Corporate Tax Documents cannot be overstated. This article has delineated the critical role professional translators play in converting financial data into a comprehensible language while maintaining precision and authenticity. The distinctions between certified and non-certified translations have been clarified, ensuring that readers understand the value added by such verifiable translations. A meticulous guide has provided step-by-step instructions for embarking on the translation of corporate tax returns, underscoring the necessity of adhering to legal requirements. By examining case studies where certified translations facilitated successful tax filings in the UK, the piece concludes by affirming that utilising reliable UK Corporate Tax Documents translation services is an indispensable component for businesses operating across borders.