In the UK, businesses with diverse workforces and international operations must submit multilingual corporate tax returns. The accuracy of these documents relies on specialized UK translation services, which are adept at handling legal and financial terminology to ensure precise reporting of financial data, foster trust between companies and regulatory bodies, and comply with complex tax laws. These translators are indispensable, as inaccuracies can lead to severe penalties. They provide a critical link for clear communication and integrity in financial statements within the UK's multicultural marketplace. Corporate Tax Returns UK translation services are pivotal in this process, offering expertise that combines linguistic proficiency with an intimate knowledge of UK tax law, accounting standards, and confidentiality protocols. This ensures that businesses can adhere to legal requirements, maintain financial accuracy, and uphold their reputation within the UK's corporate tax compliance framework.

navigating the complexities of corporate tax returns within the UK’s multilingual landscape, ensuring accuracy and compliance is paramount. This article delves into the critical role of professional translation services in aligning with tax regulations, emphasizing the precise handling of legal and financial terminology. By exploring key considerations for translating tax documents accurately and showcasing strategies to streamline the tax filing process with multilingual support, businesses can maintain transparency and adhereence to UK tax laws. Choosing the right translation services provider becomes a strategic decision that underpins the integrity of corporate tax returns in the UK.

- Understanding the Necessity for Multilingual Corporate Tax Returns in the UK

- The Role of Professional Translation Services in Tax Compliance

- Key Considerations for Translating Corporate Tax Documents Accurately

- Overcoming Language Barriers with Expert Tax Return Translation for UK Subsidiaries

- The Importance of Legal and Financial Terminology Precision in Translation

- Streamlining the Tax Filing Process with Multilingual Support in the UK

- Choosing the Right Translation Services Provider for Your Corporate Tax Returns UK

Understanding the Necessity for Multilingual Corporate Tax Returns in the UK

In the United Kingdom, where diversity is a cornerstone of its society and economy, the necessity for multilingual corporate tax returns cannot be overstated. Companies operating within this archipelago often have a workforce and clientele that speaks a variety of languages, making communication across these linguistic barriers essential. The UK’s translation services play a pivotal role in ensuring that corporate tax returns are accurately translated, facilitating transparency and compliance with tax regulations. This is crucial not only for the accurate reporting of financial information but also for maintaining trust between businesses and regulatory bodies. By leveraging professional translators who specialise in legal and financial documents, companies can navigate the complexities of their tax obligations without language being a barrier to understanding or compliance. Moreover, the use of UK translation services for corporate tax returns helps in avoiding miscommunications or errors that could arise from translating sensitive financial data on one’s own. This is particularly important given the UK’s stringent tax laws and the high penalties associated with non-compliance, making the provision of precise and reliable translated tax documents an indispensable aspect of corporate governance and legal obligations.

The Role of Professional Translation Services in Tax Compliance

In the complex realm of corporate tax compliance, ensuring that tax returns are both accurate and comprehensible is paramount. The UK’s diverse business landscape necessitates effective communication across various linguistic barriers. Professional translation services play a pivotal role in this process by providing precise translations of corporate tax returns for entities with international operations or multilingual teams. These specialized services not only facilitate the understanding and submission of tax documentation but also enhance the accuracy of financial reporting. By leveraging the expertise of seasoned linguists who are well-versed in both the intricacies of language and the specific jargon of corporate tax law, businesses can navigate their tax obligations with greater confidence and clarity. This is particularly important for UK companies that operate globally, as it ensures that all tax filings adhere to the UK’s stringent compliance standards, thereby mitigating the risk of penalties or legal issues due to miscommunication or misunderstandings in translated documents.

The integration of professional translation services within the tax compliance framework is a strategic move that can significantly reduce the potential for errors and omissions that might arise from using machine translations or relying on in-house staff who may not possess the necessary linguistic expertise. By engaging with providers of corporate tax returns UK translation services, businesses can rest assured that their translated documents are not only faithful to the original content but also legally sound and culturally appropriate. This level of precision is crucial for maintaining a robust tax position and avoiding the complexities that can arise from language barriers in international tax law compliance.

Key Considerations for Translating Corporate Tax Documents Accurately

When undertaking the translation of corporate tax returns in the UK, precision and accuracy are paramount to ensure compliance with legal requirements and financial integrity. Translating such documents requires a deep understanding of both the source and target languages as well as the intricate details of tax law. Professional UK translation services must employ translators with expertise in accounting terminology and familiarity with the specific tax legislation that applies to corporate entities. This dual proficiency is essential to convey complex financial information accurately, minimizing the risk of misinterpretation or legal complications arising from mistranslated figures or terms.

Moreover, the translators should be adept at utilizing specialized translation tools and software designed for handling numerical data with consistency and reliability. These tools can facilitate the conversion of financial statements and tax documents while maintaining the integrity of the original data. Additionally, confidentiality must be a cornerstone of the translation process, as corporate tax information often contains sensitive commercial and financial details. By selecting UK translation services that prioritize quality, expertise, and discretion, businesses can ensure their tax filings are accurately represented in the target language, thereby fulfilling their legal obligations and upholding their reputation.

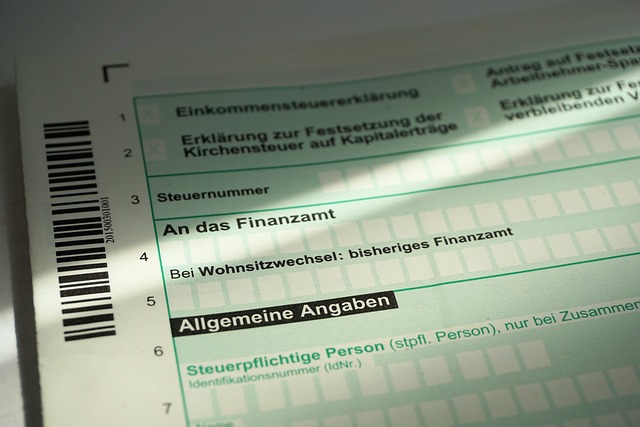

Overcoming Language Barriers with Expert Tax Return Translation for UK Subsidiaries

Navigating the complexities of corporate tax returns in the UK can be a formidable challenge for subsidiaries whose operations and reporting are primarily conducted in languages other than English. Language discrepancies can lead to misinterpretations, non-compliance, and potential legal issues if the nuances of tax legislation are not accurately conveyed. To overcome these barriers, engaging expert UK translation services is paramount. These specialized services ensure that corporate tax returns are translated with precision and expertise, reflecting the exact intentions and figures as originally reported. By facilitating clear communication between subsidiaries and the UK tax authorities, such translations help maintain transparency, adherence to legal requirements, and foster a robust compliance environment. Furthermore, these translation services are adept at handling sensitive financial data with confidentiality, ensuring that proprietary information remains secure throughout the translation process. This attention to both linguistic accuracy and data protection is crucial for subsidiaries looking to operate successfully within the UK’s regulatory framework.

The Importance of Legal and Financial Terminology Precision in Translation

In the realm of corporate finance, the precision of legal and financial terminology within translations is paramount for tax compliance, especially when considering UK translation services. The intricacies of corporate tax returns in the UK are complex and demand a deep understanding of both the source and target languages. Translators must possess specialized knowledge to accurately convey the nuances of fiscal regulations, accounting standards, and legal requirements. A minor oversight or misinterpretation of terminology can lead to significant discrepancies, potentially resulting in penalties or legal complications. Therefore, UK translation services that specialize in corporate tax returns must employ translators with expertise in both law and finance, ensuring that all numerical data, tax categories, and compliance obligations are translated accurately. This is crucial for multinational corporations operating in the UK, as precise translations facilitate transparent reporting, mitigate risks of non-compliance, and uphold an organization’s integrity and credibility with regulatory bodies.

Furthermore, the role of professional UK translation services in enhancing tax compliance cannot be overstated. These services are equipped to handle the multifaceted nature of corporate tax filings, which often contain specialized terms that require exact translations. The use of machine translation alone is insufficient due to the likelihood of errors and the need for context-specific interpretations. Human expertise is essential to ensure that each term reflects its precise meaning in the original document. This meticulous approach to translation guarantees that corporate tax returns submitted by entities are legally sound, financially accurate, and fully compliant with UK regulations, thereby avoiding potential pitfalls and ensuring smooth operations within the fiscal system.

Streamlining the Tax Filing Process with Multilingual Support in the UK

In the complex landscape of corporate tax compliance within the UK, ensuring accuracy and adherence to legal requirements is paramount for businesses operating across borders. The UK’s diverse linguistic demographic necessitates effective communication in multiple languages. Corporate Tax Returns UK translation services play a crucial role in this context by facilitating seamless interpretation of tax documents, thereby streamlining the tax filing process for companies with multilingual teams or international operations. These services bridge the language gap, allowing businesses to navigate the intricacies of tax legislation with confidence. By providing precise translations of tax returns and related documentation, these services enable organisations to submit accurate information on time, reducing the risk of misunderstandings or errors that could lead to penalties or audits. This multilingual support is not just a compliance measure but also an enabler for businesses looking to expand their operations within the UK’s multicultural environment, ensuring that language barriers do not hinder legal and fiscal responsibilities. With the UK’s Corporate Tax Returns requiring meticulous attention to detail, professional translation services are instrumental in maintaining clarity and compliance throughout the tax filing process.

Choosing the Right Translation Services Provider for Your Corporate Tax Returns UK

In the complex landscape of corporate tax compliance within the UK, ensuring that tax returns are accurately completed is paramount. When these returns require translation, selecting a reliable and expert translation services provider becomes even more critical. Corporate Tax Returns UK translation services must not only convey information precisely but also navigate the nuances of both source and target languages to avoid any misinterpretations that could lead to legal complications or financial penalties. A proficient translator with specialized knowledge in finance and taxation will be adept at handling technical jargon, accounting terms, and financial statements, ensuring that all figures and data are accurately reflected across documents. It is essential to choose a provider with a proven track record of working within the UK’s regulatory framework, as this guarantees a deeper understanding of local tax laws and practices. Furthermore, opting for a service that offers multilingual capabilities and a commitment to confidentiality will safeguard sensitive financial information while facilitating seamless communication between international entities and the UK tax authorities. By partnering with a trustworthy translation services provider that specializes in Corporate Tax Returns UK, businesses can mitigate risks associated with language barriers and maintain compliance with UK tax regulations.

In conclusion, ensuring tax compliance for multinational entities operating within the UK necessitates robust and precise translation services for corporate tax returns. The article has highlighted the critical nature of providing these returns in the languages of their respective subsidiaries, underscored the indispensable role of professional translators who specialise in legal and financial terminology, and outlined the strategic advantages of streamlining this process through dedicated multilingual support. Companies must carefully select translation services providers that offer accuracy, expertise, and a deep understanding of the intricacies involved in corporate tax returns UK to foster transparency, adherence, and compliance with UK tax laws. By doing so, they not only safeguard their legal standing but also uphold the integrity of the global financial landscape.