Corporate Tax Returns UK translation services are indispensable for multinational companies looking to accurately translate their financial documents to comply with local tax regulations across different countries. These specialized services ensure that translators not only possess linguistic proficiency but also have a deep understanding of both the source and target tax laws, terminologies, and legal contexts. This expertise allows for precise translation of complex tax terminology and ensures that the intent and meaning of UK corporate tax returns are accurately conveyed in various languages, thereby preventing misinterpretation and maintaining compliance with international tax authorities. By leveraging the expertise of UK translation services, companies can navigate the linguistic and cultural challenges of global expansion, ensuring their financial communications are both accurate and legally sound across all operational territories.

navigating corporate tax complexities, legal requirements for multinational tax documentation, professional translators’ role in cross-border compliance, accurate financial document translation, reliable corporate tax return translation providers, best practices for localizing tax-related legal texts, ensuring consistency in multilingual tax doc sets, technical expertise in tax terminology, communicating with international tax authorities, case studies on global tax translations, leveraging technology for tax document translations, cultural nuances’ impact on tax text translation, confidentiality and data security in tax document handling, overcoming language barriers in M&A due diligence, multilingual tax professionals’ role in business expansion, adapting to different accounting standards in international tax translations, utilizing UK translation services for compliance, comparative analysis of UK vs. non-UK tax systems, consequences of inaccurate tax reporting translations, selecting the right translation service for corporate tax needs.

- Navigating the Complexities of Corporate Tax Returns UK Translation Services

- Understanding the Legal Requirements for Multinational Tax Documentation

- The Role of Professional Translators in Cross-Border Tax Compliance

- Key Considerations for Accurate Translation of Financial Documents

- Identifying Reliable Corporate Tax Return Translation Providers

- Best Practices for Translating and Localizing Tax-Related Legal Texts

- Ensuring Consistency Across Multilingual Tax Documentation Sets

- The Importance of Technical Expertise in Tax Terminology Translation Services

- Strategies for Effective Communication with International Tax Authorities

- Case Studies: Successful Corporate Tax Return Translations for Global Operations

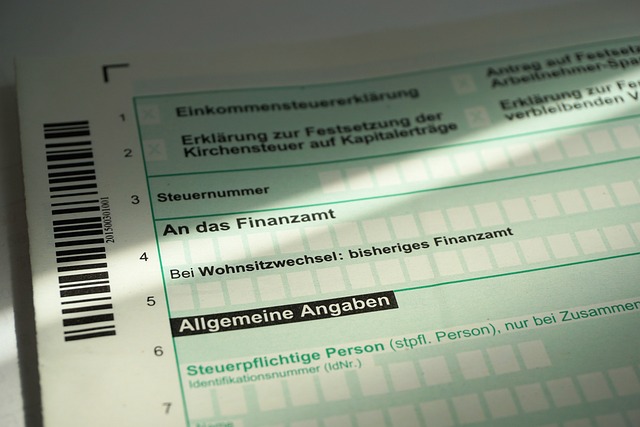

Navigating the Complexities of Corporate Tax Returns UK Translation Services

When it comes to corporate tax returns in the UK, the intricacies and legal jargon can pose significant challenges for businesses looking to expand their reach or operate across borders. Accurate translation of these documents is not just a matter of linguistic equivalence but a complex task that requires an understanding of both language nuances and the specific tax regulations applicable in the UK. This is where specialist UK translation services excel, offering precise translations that are faithful to the original content while ensuring compliance with legal standards. These services are staffed by professionals who are not only adept linguists but also experts in financial terminology, enabling them to handle corporate tax returns with the care and attention to detail they demand. By leveraging the expertise of these UK translation services, businesses can navigate the complexities of international tax compliance, ensuring that their tax submissions are both legally sound and culturally appropriate for the target audience. This meticulous approach not only upholds the integrity of the financial reporting but also facilitates seamless communication with tax authorities in different jurisdictions, thereby mitigating the risks associated with multinational operations.

Understanding the Legal Requirements for Multinational Tax Documentation

When multinational corporations operate across different jurisdictions, it becomes imperative to navigate the complex landscape of international tax laws. The translation of corporate tax returns from the UK, for instance, requires not just linguistic accuracy but also a deep understanding of legal nuances. Trusted translation services specializing in this field must be well-versed in the intricacies of tax legislation and the specific requirements that govern financial disclosures across borders. These documents often contain sensitive information subject to strict confidentiality agreements, necessitating translators who are not only proficient in multiple languages but also bound by professional secrecy. The legal requirements for multinational tax documentation ensure compliance with local laws and regulations, which is crucial for accurate reporting and avoiding legal repercussions. Furthermore, the translation must be precise to reflect the intent and meaning of the original text, as misinterpretations or errors in translations can lead to discrepancies in financial statements and potentially significant tax liabilities. To meet these demands, corporate tax returns UK translation services employ expert linguists and legal experts who work in tandem to provide accurate and legally compliant translations that are essential for businesses with a global footprint. This meticulous process ensures that all disclosures are transparent and understandable to stakeholders in any language, facilitating informed decision-making and legal certainty.

The Role of Professional Translators in Cross-Border Tax Compliance

In the realm of cross-border tax compliance, the role of professional translators is pivotal, especially when it comes to corporate tax returns in the UK. Accurate translation services are not merely a matter of language equivalence; they are integral to ensuring legal and fiscal compliance across different jurisdictions. Expert translators familiar with the intricacies of tax legislation in both the source and target languages provide a critical link, enabling multinational corporations to navigate the complexities of international tax regulations seamlessly. These specialists go beyond mere word-for-word translation; they employ nuanced understanding and context-specific knowledge to convey the precise intent of the original document, ensuring that tax returns are not only translated but also interpreted correctly to align with local accounting standards and tax laws. This meticulous approach is crucial for multinational enterprises operating in diverse economic climates, as it avoids potential misinterpretations and costly errors that could arise from mistranslations or oversights in the translation process. By leveraging the expertise of seasoned corporate tax returns UK translation services, companies can confidently submit translations that are compliant with both local and international tax authorities’ requirements, thereby safeguarding their financial integrity and operational continuity on a global scale.

Key Considerations for Accurate Translation of Financial Documents

When translating corporate tax returns from the UK for global use, precision and accuracy are paramount to ensure legal compliance and financial integrity across different jurisdictions. A key consideration in this process is the selection of translation services that specialize in legal and financial terminology. These services must possess a deep understanding of both the source and target languages, as well as the nuances inherent in tax legislation. The complexity of corporate tax returns often necessitates a team approach, with subject matter experts working alongside professional translators to navigate intricate language and technical terms specific to fiscal regulations. This collaborative effort minimizes the risk of misinterpretation or mistranslation, which could lead to financial discrepancies and legal repercussions.

Moreover, the chosen translation services should employ consistent terminology throughout the document to convey uniform meaning. This is crucial for maintaining the integrity of the original content. Utilizing advanced translation technology, such as computational linguistics and machine learning algorithms, can further enhance the accuracy of translations by addressing common pitfalls in human translation, like idiomatic expressions and industry-specific jargon. By leveraging a combination of expert linguistic skills and state-of-the-art technology, companies can ensure their corporate tax returns are accurately translated for global use, thereby upholding transparency and compliance with international standards.

Identifying Reliable Corporate Tax Return Translation Providers

When a corporation operates on an international scale, the translation of its tax documents becomes paramount for accurate reporting and compliance with various jurisdictions’ regulations. In the context of corporate tax returns from the UK, reliability in translation services is not just about linguistic accuracy; it encompasses a comprehensive understanding of the intricate details within these documents. Businesses seeking trusted translation providers must prioritize expertise in both legal and financial terminology, coupled with proficiency in the target language’s nuances. It is crucial to choose translators who specialize in corporate tax returns, as they are well-versed in the specific jargon and disclosure requirements that are often unique to UK tax documents. These experts ensure that the translated content mirrors the precision and intent of the original text, which is essential for maintaining transparency and fulfilling legal obligations across different countries. Companies should look for translation services with a proven track record in this niche, offering not just bilingual capabilities but also a deep grasp of international tax compliance and reporting standards. This level of specialization minimizes the risk of misinterpretation or omission of critical financial data, safeguarding the integrity of corporate tax returns when used globally.

Best Practices for Translating and Localizing Tax-Related Legal Texts

When venturing into the realm of translating and localizing tax-related legal texts, precision and accuracy are paramount. Corporations operating internationally must ensure their tax documents, such as UK corporate tax returns, are not only translated but also adapted to reflect the linguistic and cultural nuances of each target market. This process, known as localization, transcends mere word-for-word translation; it involves adapting content to be relevant and appropriate for a specific audience while maintaining the original intent and meaning. To achieve this, it is crucial to engage with translation services that specialize in legal documents and possess expert knowledge of tax legislation. These services employ translators who are not only linguistically proficient but also well-versed in the intricacies of tax law, enabling them to handle complex terminology accurately.

To guarantee the integrity and compliance of corporate tax returns when translated for global use, translation teams should follow best practices that include a deep understanding of both the source and target languages’ legal terms and concepts. Collaboration between bilingual tax experts and professional translators is essential. This partnership ensures that all numerical data, legal jargon, and context-specific language are accurately conveyed. Moreover, employing a rigorous quality assurance process, including peer reviews and the use of advanced translation technology, can help mitigate errors and inconsistencies. By adhering to these best practices, corporations can navigate the complexities of international tax compliance with confidence, ensuring their UK corporate tax returns are accurately translated and localized for each jurisdiction they operate in.

Ensuring Consistency Across Multilingual Tax Documentation Sets

Companies operating in multiple countries must navigate the complexities of tax compliance across different jurisdictions. A key challenge in this multifaceted endeavor is ensuring consistency in tax documentation when translating corporate tax returns from the UK for use in various languages and cultural contexts. To address this, specialized UK translation services play a pivotal role. These services not only facilitate the linguistic transfer of information but also ensure that the translated documents reflect the nuances and legal precision required by international standards. By leveraging expert translators with a deep understanding of both tax law and language-specific idiosyncrasies, these services provide a cohesive and accurate representation of the original UK corporate tax returns. This consistency is paramount in avoiding misinterpretations that could lead to legal complications or financial penalties. Moreover, the use of translation memory software and glossaries tailored to financial terminology further enhances the reliability and uniformity of the translated documents. This meticulous approach to multilingual tax document translation is indispensable for global corporations seeking to maintain transparency and compliance in their international operations.

The Importance of Technical Expertise in Tax Terminology Translation Services

In the realm of corporate finance, the precision and accuracy of tax terminology are paramount when translating documents for global use. Corporate Tax Returns UK translation services must be staffed by professionals with a deep technical expertise in tax law and terminology to ensure that all financial nuances are accurately conveyed across different languages. The intricate details within tax documentation often contain specific jargon and complex concepts unique to the field of taxation, necessitating a translator who is not only fluent in the target language but also well-versed in the source taxonomy. This level of specialization ensures that translations are legally sound and reflect the intent and meaning of the original documents. Companies looking to navigate international markets rely on these services to avoid misinterpretation, legal complications, and costly errors in reporting. The importance of technical expertise cannot be overstated; it is the cornerstone of reliable corporate tax returns UK translation services that facilitate compliance and effective communication with global stakeholders.

Furthermore, the translators must be adept at handling sensitive financial data with discretion and professionalism. They must stay abreast of legislative changes and updates in tax laws to provide up-to-date translations. This ongoing education and adaptation are crucial for maintaining the integrity of the documents being translated. The use of advanced translation technologies, combined with human expertise, ensures that corporate tax returns prepared in the UK can be accurately translated into other languages, providing clarity and trust for multinational enterprises operating on a global scale. It is this blend of technical acumen and linguistic proficiency that sets apart exceptional translation services within the corporate tax sector.

Strategies for Effective Communication with International Tax Authorities

When navigating the complexities of corporate tax returns within an international context, leveraging specialized UK translation services is paramount for seamless communication with tax authorities across different regions. Effective strategies must be employed to ensure that the nuances and legal implications of financial statements are accurately conveyed in the target language. Translators with expertise in both accounting and linguistics should be engaged to provide precise translations, minimizing the risk of misinterpretation or errors that could lead to tax disputes or penalties. A meticulous approach involves not only a word-for-word translation but also an adaptation to local regulations and terminologies to avoid any ambiguity. Additionally, employing native speakers as reviewers can enhance the accuracy and cultural relevance of the translated documents, ensuring they align with the expectations of international tax authorities. By adopting these best practices, businesses can confidently submit their corporate tax returns in different countries, facilitated by top-tier UK translation services, thereby upholding compliance and fostering a positive relationship with tax authorities globally. Implementing robust communication protocols with these specialized translation services is essential for organizations looking to streamline their international tax operations and mitigate the risks associated with language barriers.

Case Studies: Successful Corporate Tax Return Translations for Global Operations

Companies operating in a global landscape often encounter the challenge of translating their corporate tax returns to comply with local regulations while maintaining accuracy and legal integrity. A prime example is the case of a multinational corporation headquartered in the UK that expanded its operations across Europe. To align with the regulatory framework of each country, the company utilized specialized UK translation services to accurately translate its corporate tax returns. This strategic move not only demonstrated compliance but also fostered transparency and trust among stakeholders in different jurisdictions. The translations were meticulously handled by experts who were well-versed in both the source and target languages as well as the intricate details of tax legislation. As a result, the company avoided potential legal pitfalls and ensured seamless operations across borders, with its annual filings accurately reflecting the financial position in each localized market. Similarly, another firm leveraged these services to enter new markets in Asia, successfully navigating complex tax environments by presenting translated documents that were both precise and culturally appropriate. These case studies highlight the critical role of professional UK translation services in facilitating global corporate tax compliance, thereby enabling companies to expand their reach without compromising on legal accuracy or operational efficiency.

In concluding, the meticulous translation of corporate tax documents is a pivotal aspect of global business operations. Companies operating across borders must navigate the intricate web of legal requirements and linguistic nuances to ensure compliance and accuracy in their tax documentation. The expertise provided by specialized UK translation services plays a critical role in this process, offering peace of mind through precise and consistent translations that uphold both legal standards and financial integrity. By adhering to best practices and leveraging the technical acumen of professional translators who specialize in tax terminology, businesses can confidently engage with international tax authorities, thereby facilitating seamless global operations. The case studies highlighted throughout this article underscore the tangible benefits of investing in high-caliber translation services for corporate tax returns, demonstrating that with the right approach, multinational corporations can successfully manage their tax obligations across different jurisdictions.