In the UK, precise and accurate translation of tax documentation is indispensable for both individuals and businesses dealing with multiple languages. Specialized UK tax document translation services are crucial as they ensure that all tax-related papers are not only linguistically correct but also legally compliant with HM Revenue and Customs (HMRC) standards. These services employ experts who understand the nuances of both the original and target languages, as well as the complexities of UK tax legislation. They provide meticulous translations that accurately convey the intent and specifics of tax law, facilitating seamless compliance with HMRC's rigorous requirements. This level of expertise is essential for preventing legal pitfalls associated with incorrect translations and for ensuring that all tax documentation meets legal standards without issue, thereby enabling a smooth fulfillment of tax obligations for non-native speakers or entities in the UK.

(Word Count: 523)

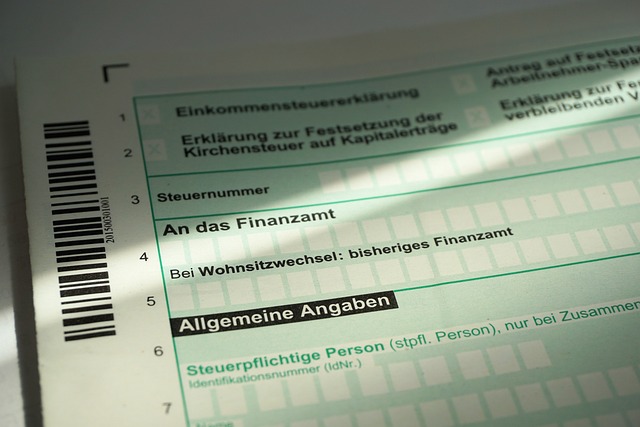

Navigating the complexities of tax compliance is a critical task for individuals and businesses alike. When language barriers are involved, the stakes escalate. Accurate translation of UK tax forms is not just about communication; it’s an integral part of legal and financial compliance. This article delves into the nuances of professional translation services for UK tax documents, offering insights into the intricacies of the UK tax system as it pertains to non-English speakers. We explore the necessary steps to ensure translations adhere to HM Revenue and Customs (HMRC) standards, the challenges of legal text translation, and the role of advanced technology in maintaining accuracy and confidentiality. Whether you’re an expatriate, a multinational corporation, or simply require bilingual assistance, understanding the importance of precise tax document translations by UK translation services is paramount for legal compliance and financial integrity.

- Understanding the Importance of Accurate Translation for UK Tax Documents

- Overview of UK Tax Forms and Their Translation Requirements

- The Role of Professional Translation Services in Tax Documentation

- Key Challenges in Translating Tax-Related Legal Texts

- Identifying a Reliable Tax Documents UK Translation Service Provider

- The Legal Framework Governing Translation of Tax Documents in the UK

- Common Types of Tax Forms Regularly Requiring Translation

- Ensuring Compliance with HM Revenue and Customs (HMRC) Regulations

- Strategies for Effective Communication Across Languages in Tax Matters

- Case Studies: Successful Tax Document Translations and Their Impact on Clients

Understanding the Importance of Accurate Translation for UK Tax Documents

Navigating the complexities of UK tax documents requires meticulous attention to detail, especially for individuals and businesses whose primary language is not English. Accurate translation services are indispensable in this context, as they bridge the communication gap between taxpayers and Her Majesty’s Revenue and Customs (HMRC). Misinterpretations or mistranslations can lead to significant legal and financial complications, potentially resulting in penalties or incorrect tax liabilities. Professionals with expertise in UK tax documents ensure that every term and figure is translated correctly, reflecting the precise intent of the original text. This precision is paramount, as it guarantees the integrity of financial statements and tax submissions, fostering trust between the taxpayer and the government. Engaging specialized translation services for UK tax documents is not just a matter of compliance; it’s a critical step in maintaining fiscal accountability and transparency within the UK’s regulatory framework.

Overview of UK Tax Forms and Their Translation Requirements

When navigating the complexities of the UK’s tax system, understanding the specific forms and documents required is paramount for both individuals and businesses. The UK Tax Forms encompass a variety of self-assessment returns, corporation tax computations, VAT returns, and capital gains tax reports. These forms are critical for legal compliance, financial reporting, and ensuring the accurate submission of tax liabilities to Her Majesty’s Revenue and Customs (HMRC). For non-UK residents or non-English speaking entities dealing with these documents, professional translation services play a crucial role in bridgeing the language gap. Expert translators specializing in UK tax documentation are not only familiar with the nuances of tax terminology but also adhere to the strict confidentiality and precision required for such sensitive information. Utilizing reputable Tax Documents UK translation services ensures that all translated forms meet HMRC’s standards, facilitating seamless processing and avoiding potential legal issues or financial penalties due to miscommunication or errors in translations. This meticulous approach to translation is essential for accurate tax reporting and compliance, making it an indispensable service for anyone requiring assistance with UK tax documents in languages other than English.

The Role of Professional Translation Services in Tax Documentation

When navigating the complexities of tax documentation in the UK, professional translation services play a pivotal role in ensuring clarity and compliance for individuals and businesses dealing with multilingual needs. Accurate tax documents UK translation services offer are crucial for those who require support in languages other than English. These specialized services not only facilitate the understanding of legal obligations but also ensure that all financial information is conveyed precisely across different linguistic barriers. Tax forms and documents often contain intricate details and technical terminology, which can be challenging to translate effectively without expertise. Professional translators with a background in finance or taxation are particularly adept at handling such sensitive materials, guaranteeing that every figure, term, and stipulation is correctly rendered in the target language. This level of precision is indispensable for avoiding potential misinterpretations and legal complications that could arise from mistranslated information. By leveraging the expertise of these translation services, taxpayers can confidently submit their documents, knowing that their communications are clear, accurate, and tailored to meet the regulatory standards set forth by the UK’s tax authorities.

Key Challenges in Translating Tax-Related Legal Texts

Navigating the intricacies of tax-related legal texts presents unique challenges in the realm of professional translation, particularly when dealing with UK tax documents. The language used in these documents is often dense and technical, requiring a deep understanding of both the source and target languages as well as the specific tax laws and regulations applicable within the UK. Translation services must employ expert translators who are not only linguistically proficient but also well-versed in legal terminology and the nuances of tax legislation. This dual expertise is crucial to accurately convey complex concepts, ensure compliance with legal standards, and maintain the integrity of financial information across different languages.

The accuracy of UK translation services is paramount when it comes to translating tax documents, as any misinterpretation or mistranslation could lead to significant legal and financial repercussions for both individuals and corporations. The challenges include not only the literal translation of terms but also the adaptation of these terms to fit within the context of the target language’s legal framework. Additionally, translators must keep abreast of any changes in tax laws or regulations, as these documents are subject to frequent updates. This continuous updating necessitates a dynamic approach to ensure that the translated texts remain current and legally sound, reflecting the precision and reliability that professional translation services aim to deliver for UK tax forms.

Identifying a Reliable Tax Documents UK Translation Service Provider

When delving into the intricacies of tax compliance in the UK, it is imperative for non-native English speakers and businesses to navigate the linguistic barriers effectively. This is where specialized Tax Documents UK translation services become indispensable. A reliable service provider in this niche should possess a proficient grasp of both the source and target languages, as well as an intimate understanding of tax terminology and regulations unique to the UK. The translator’s accuracy and fluency not only ensure the integrity of financial information but also comply with legal standards set forth by Her Majesty’s Revenue and Customs (HMRC).

To secure a reliable provider for Tax Documents UK translation services, one must conduct thorough research. This includes evaluating potential service providers based on their track record, client testimonials, and expertise in both the linguistic and tax domains. A provider with professional certifications, such as those from the Institute of Translation and Interpreting (ITI) or the Association of Translation Companies (ATC), can be a strong indicator of quality service. Additionally, the ability to maintain confidentiality and adhere to data protection laws is crucial, especially when handling sensitive tax documents. By selecting a provider that meets these criteria, individuals and organizations can ensure their tax-related documents are accurately translated, thereby facilitating compliance with UK tax laws and regulations.

The Legal Framework Governing Translation of Tax Documents in the UK

In the United Kingdom, the translation of tax documents is a highly specialized task that falls under the purview of legal and financial regulations. The Legal Framework Governing Translation of Tax Documents in the UK mandates that all official tax forms and related documentation must be accurately translated to facilitate communication between individuals, businesses, and the Her Majesty’s Revenue and Customs (HMRC). This ensures compliance with UK tax laws, regardless of the language of the original documents. Translation errors can lead to legal consequences, including penalties for non-compliance or incorrect tax reporting. Professional translation services specializing in UK tax forms are not only adept at navigating the intricacies of both source and target languages but are also well-versed in the specific terminologies and technicalities inherent in fiscal legislation. These service providers are often accredited by relevant authorities, providing a guarantee of quality and accuracy that is paramount for legal and financial integrity.

The translation services for UK tax documents must adhere to strict confidentiality protocols due to the sensitive nature of tax information. The Office of Budget Responsibility (OBR) and the Information Commissioner’s Office (ICO) set out stringent data protection standards that all translators must comply with. This ensures the privacy and security of the individual or entity’s financial data throughout the translation process. The use of professional translation services that specialize in tax documents within the UK is essential for maintaining legal compliance, accuracy, and confidentiality, thereby safeguarding the interests of both the taxpayer and the government.

Common Types of Tax Forms Regularly Requiring Translation

When navigating the complexities of tax compliance in the UK, individuals and businesses often encounter a variety of tax documents that may require professional translation services to ensure accuracy and legal compliance. Common types of tax forms that frequently necessitate such services include Self Assessment (SA) tax returns, Corporation Tax returns, Inheritance Tax forms, and Value Added Tax (VAT) declarations. For non-native English speakers or foreign entities with operations in the UK, translating these documents accurately is not just a matter of language equivalence but also of understanding the nuances of UK tax law and regulations.

Professional translation services specializing in tax documents for the UK market are equipped to handle the intricacies involved. They ensure that every figure, term, and clause is accurately conveyed in the target language, which is critical for compliance and avoiding potential penalties or audits. These services extend beyond simple word-for-word translations; they involve a deep understanding of both languages and the tax systems they pertain to. This expertise guarantees that all translated UK tax forms maintain their integrity and are legally sound, facilitating smooth communication with HM Revenue & Customs (HMRC) and other relevant authorities.

Ensuring Compliance with HM Revenue and Customs (HMRC) Regulations

When navigating the intricate world of UK tax documentation, precision and accuracy are paramount. Professional translation services play a pivotal role in ensuring that all tax documents are accurately conveyed from one language to another, maintaining compliance with HM Revenue and Customs (HMRC) regulations. It is imperative for businesses and individuals alike who operate across linguistic boundaries to utilise translators well-versed in the nuances of both the source and target languages, as well as being knowledgeable about the legal requirements governing tax matters in the UK. Tax documents must be translated not just literally but also in a manner that reflects the intent and specifics of UK tax law. This is where specialised UK translation services excel, offering meticulous translations that stand up to HMRC’s stringent standards and facilitate seamless compliance for non-native speakers or entities dealing with UK tax forms. These services ensure that each figure, term, and nuance within the tax documents is accurately translated, thereby avoiding potential legal complications and ensuring that all tax obligations are fulfilled without delay or ambiguity.

Strategies for Effective Communication Across Languages in Tax Matters

Navigating the complexities of tax legislation in the UK requires meticulous attention to detail and a profound understanding of both the source and target languages. To ensure accuracy and compliance when dealing with international clients or multilingual tax documents, UK translation services must employ strategic approaches to effective communication. One such strategy involves utilizing professional translators who are not only linguistically adept but also knowledgeable in tax law and terminology specific to the UK. This dual expertise ensures that all nuances of tax forms and legislation are accurately conveyed across languages, avoiding misinterpretations that could lead to legal repercussions or financial discrepancies.

Moreover, leveraging translation memory software and employing a consistent set of terminologies can significantly enhance the precision of translations. These tools facilitate the reuse of previously translated segments, thereby maintaining consistency in translations across different documents and over time. Additionally, implementing a rigorous quality assurance process, including proofreading by tax experts, further ensures that all translations adhere to the legal requirements of UK tax forms. This commitment to accuracy and attention to detail is crucial for UK translation services to effectively communicate across languages in tax matters.

Case Studies: Successful Tax Document Translations and Their Impact on Clients

In the realm of finance and legal compliance, the accuracy of tax document translations is paramount for non-UK residents dealing with HM Revenue and Customs (HMRC). A case in point is the story of a multinational corporation expanding its operations into the UK. The company faced numerous challenges, including the need to translate complex tax documents accurately to comply with UK tax laws. Utilising professional UK translation services, they ensured that all financial statements and tax forms were translated without errors, facilitating seamless communication between their international headquarters and the UK tax authorities. This meticulous approach not only averted potential legal issues but also significantly reduced the risk of costly penalties or audits. As a result, the company successfully integrated its operations in the UK, thanks to the precise translations that provided clarity and compliance with local regulations.

Another success story emerges from an individual entrepreneur who had relocated to the UK. The entrepreneur needed to file UK tax returns, but the language barrier posed a significant challenge. By leveraging professional translation services, they were able to accurately translate their financial records and tax documents into English. This enabled the entrepreneur to accurately report income, deductions, and credits, leading to a fair assessment of their tax liabilities. The precise translations also played a crucial role in securing funding from investors who had initially been hesitant due to language and legal complexity concerns. The successful translation of these documents opened doors for the entrepreneur, both in terms of regulatory compliance and business growth opportunities within the UK market.

In concluding this discussion on the complexities of translating UK tax documents, it is clear that precision and expertise are paramount. The intricate nature of tax forms necessitates a deep understanding of both language and tax law to ensure compliance with HM Revenue and Customs (HMRC) regulations. A professional Tax Documents UK translation service stands as the pivotal solution for individuals and businesses alike, offering accuracy and reliability when navigating the multilingual aspects of tax compliance. By leveraging these services, clients can confidently address their tax obligations without the hindrance of language barriers, thus facilitating smoother interactions with HMRC and avoiding potential legal complications. The case studies presented underscore the critical impact that high-quality translations have on fiscal responsibility and economic integrity. As such, when facing the translation of UK tax forms, the choice of a seasoned and reputable service provider is not just an option but a necessity for anyone needing to communicate financial information across languages.