Translation services for Insurance Claim Documents UK have become an integral part of the insurance industry's evolution, addressing the linguistic diversity within the country by providing multilingual support. These services ensure that policyholders who are not native English speakers can understand and navigate the claims process effectively. By offering precise translations in multiple languages, these translation services remove language barriers, enhance transparency, build trust, and uphold inclusivity. They also comply with stringent data protection laws, safeguarding sensitive personal information while facilitating the claims process. This commitment to comprehensive customer service not only improves satisfaction rates but also positions insurance companies as market leaders who value diversity and excellence in client relations. As a result, these translation services are a strategic asset for UK insurers, enabling them to cater to a broader demographic with efficiency and respect, thereby fostering loyalty and positive referrals within the competitive UK insurance landscape.

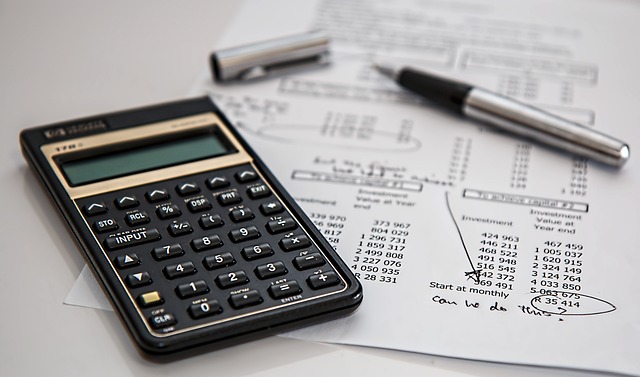

navigating insurance claims can be a complex task, especially for individuals who are not native English speakers. In the UK, where diversity is a hallmark of its citizenry, ensuring clear and accurate communication through professional translation services for insurance claim documents is paramount. This article delves into the critical role these services play in enhancing customer experience, addressing the challenges faced by non-native speakers, and maintaining compliance with stringent data protection laws. By examining the importance of multilingual support within the UK insurance sector, we illuminate how translation services not only facilitate better understanding but also significantly improve overall customer satisfaction. Furthermore, a case study illustrates the tangible benefits of integrating these services into the insurance claim process.

- Understanding the Importance of Multilingual Support in the UK Insurance Sector

- The Role of Professional Translation Services for Insurance Claim Documents in the UK

- Challenges Faced by Non-Native Speakers When Filing Insurance Claims in the UK

- How Translation Services Enhance Customer Experience and Satisfaction

- Compliance with Data Protection and Privacy Laws in Translating Insurance Documents

- Case Study: Successful Implementation of Translation Services for Insurance Claim Forms in the UK

Understanding the Importance of Multilingual Support in the UK Insurance Sector

In the dynamic and customer-centric landscape of the UK insurance sector, the provision of multilingual support has become increasingly significant in enhancing the customer experience. As the UK continues to be a melting pot of cultures, with individuals from diverse linguistic backgrounds residing within its borders, the need for seamless communication is paramount. Translation services for Insurance Claim Documents UK play a pivotal role in this context, bridging language barriers and ensuring that policyholders can understand and navigate their insurance claim forms without impediment. This not only promotes clarity and transparency but also fosters trust between the insurer and the policyholder. By offering accurate and reliable translation services, insurance companies demonstrate a commitment to inclusivity, thereby catering to a wider customer base and providing a tailored service that aligns with the multicultural reality of the UK. This level of support is not just a value-added service; it is an essential aspect of operational efficiency and customer satisfaction, which can lead to increased loyalty and positive word-of-mouth referrals. As such, integrating professional translation services for insurance claim documents becomes a strategic advantage in a competitive marketplace, ensuring that all customers, regardless of their linguistic abilities, receive the same level of care and understanding.

The Role of Professional Translation Services for Insurance Claim Documents in the UK

Navigating the aftermath of an incident that necessitates filing an insurance claim can be a complex and stressful process for individuals, particularly when language barriers are involved. In the UK, where a diverse population resides, professional translation services play a pivotal role in ensuring that insurance claim documents are accessible and comprehensible to all customers, regardless of their native language. These services bridge the gap between policyholders and insurers by providing accurate translations of insurance claim forms, terms and conditions, and policy details. This not only facilitates clear communication but also upholds the integrity of the claims process, reducing misunderstandings and potential disputes.

The accuracy and cultural nuance provided by professional translation services for insurance claim documents in the UK are paramount. They ensure that the content remains faithful to the original text while being presented in a way that is understandable to non-English speakers. By leveraging the expertise of linguistic professionals who specialise in legal and technical terminology, these services safeguard the rights and interests of policyholders. As a result, insurance companies can enhance customer satisfaction, foster trust, and demonstrate their commitment to inclusivity and service excellence within diverse communities across the UK.

Challenges Faced by Non-Native Speakers When Filing Insurance Claims in the UK

Non-native speakers navigating the insurance claim process in the UK often encounter significant linguistic barriers. The complexity of insurance claim forms and the precise terminology used can be daunting, leading to misunderstandings or errors that may jeopardise the claim’s outcome. This language difficulty not only hampers effective communication but also increases the likelihood of claims being delayed, misinterpreted, or even rejected. To address this issue, utilising translation services for insurance claim documents in the UK is crucial. These services bridge the gap between policyholders and insurers by accurately conveying the necessary information in the preferred language of the claimant. This ensures that all parties involved have a clear understanding of the terms and conditions, coverage details, and claim procedures, thereby facilitating a smoother and more efficient claims process. By leveraging professional translation services, non-native speakers can file their claims with greater confidence and clarity, significantly enhancing their customer experience and satisfaction with UK insurance providers.

How Translation Services Enhance Customer Experience and Satisfaction

In the United Kingdom, where cultural and linguistic diversity is a hallmark of society, insurance claim forms presented in the native language of policyholders can significantly enhance customer experience and satisfaction. Utilising professional translation services for Insurance Claim Documents UK is not just about overcoming language barriers; it’s about demonstrating empathy and respect for clients from different backgrounds. When clients receive insurance claim forms in their first language, they can navigate the process with greater ease and confidence, leading to a more intuitive and less stressful experience. This is particularly crucial in the insurance sector where understanding the specifics of a claim is fundamental. By ensuring clarity and accuracy in translated documents, insurance companies can reduce miscommunication, expedite claim processing, and foster trust, which are all pivotal for maintaining high customer satisfaction levels.

Furthermore, the use of top-tier translation services for Insurance Claim Documents UK is not just a customer service enhancement; it’s also a strategic business move. It ensures compliance with legal standards set forth by the Financial Conduct Authority (FCA) and other regulatory bodies, which mandate that clients can understand the documents they are signing. By leveraging expert translators who specialise in the nuances of both insurance jargon and the subtleties of different languages, companies provide a service that is not only accessible but also professional and reliable. This commitment to clear communication reflects positively on the insurer’s reputation and customer relations, ultimately contributing to sustained growth and competitive advantage within the UK market.

Compliance with Data Protection and Privacy Laws in Translating Insurance Documents

In the United Kingdom, the translation of insurance claim documents is a sensitive task that requires adherence to stringent data protection and privacy laws. The General Data Protection Regulation (GDPR) and the UK’s Data Protection Act 2018 establish clear guidelines on how personal data should be handled, processed, and protected. When providing translation services for insurance claim documents in the UK, it is imperative that translators are not only proficient in both source and target languages but also well-versed in the legal requirements governing data privacy. This ensures that policyholders’ sensitive information, such as personal details, financial information, and claims history, remains secure throughout the translation process. Translators must handle all documentation with the utmost confidentiality, maintaining the integrity of the original text while complying with these regulations.

The importance of compliance cannot be overstated, as non-compliance can lead to significant penalties for insurance companies and translate services providers. To mitigate this risk, it is essential that translation service providers in the UK implement robust data governance frameworks. These frameworks should include secure data transfer protocols, access controls, and regular audits to ensure ongoing compliance with GDPR and the Data Protection Act. By doing so, these providers not only safeguard customer data but also foster a trustworthy environment where customers can confidently submit their insurance claims, knowing that their personal information is being managed responsibly and transparently. This commitment to privacy and legal compliance enhances the overall customer experience and reinforces the reputation of the UK’s insurance industry as a whole.

Case Study: Successful Implementation of Translation Services for Insurance Claim Forms in the UK

In the UK, where a significant proportion of the population hails from diverse linguistic backgrounds, the provision of translation services for insurance claim documents has become paramount in enhancing customer experience and inclusivity. A notable case study illustrating the successful implementation of such translation services is that of a major insurance provider, which observed a substantial segment of its customer base experiencing difficulties with English-only claim forms. Recognizing the linguistic diversity within its clientele, the insurer decided to integrate multilingual support for their claim documents. This strategic move not only facilitated clearer communication and reduced misunderstandings but also significantly improved response times by enabling clients to complete and submit claims in their preferred language. As a result, customer satisfaction scores saw a marked increase, with positive feedback highlighting the ease of use and the appreciation for being catered to in their native tongue. The insurance company’s commitment to providing translation services for insurance claim documents in the UK has set a benchmark for industry standards, demonstrating that inclusivity and customer care are not just buzzwords but essential operational principles. This initiative has not only broadened market reach but also reinforced the insurer’s reputation as a customer-centric organisation, ultimately leading to increased loyalty and client retention rates.

Effective communication is paramount in the insurance sector, and translating insurance claim documents into the policyholder’s preferred language through professional translation services not only aligns with legal requirements but also significantly enhances customer experience and satisfaction in the UK. By addressing the challenges faced by non-native speakers, insurers ensure compliance with data protection and privacy laws while providing clear, accurate, and accessible information. The successful implementation of such translation services, as evidenced by a case study presented, underscores the positive impact on customer relations and the operational efficiency of insurance companies. As the UK continues to be a multicultural society, the provision of multilingual support through specialized translation services for insurance claim documents becomes increasingly indispensable. This proactive approach not only improves customer service but also demonstrates an inclusive commitment to serving the diverse needs of clients, thereby solidifying trust and fostering loyalty in the UK insurance market.